Moving to a new country is exciting, sure, but its also really overwhelming. Flights, documents, finding a place to stay, figuring out groceries, and just surviving your first week without spending too much. One of the things I’ve been stressing about the most is money. How do I keep some cash for myself? How do I make sure I can send money back home? How do I avoid all those hidden bank fees that eat up half of your hard-earned dollars? That’s why I decided to start using Wise even before I leave.

I actually first learned about Wise when my mom was in the US. She’s been sending money back home for years using it and I remember watching her do it. It looked so simple and smooth unlike the old-school way of sending cash through banks which always seemed confusing and expensive. Back then I didn’t think much about it but now that I’m moving to the US I see it as way more than just a remittance tool. For me, Wise is going to be my first-month pocket money manager and my bridge for sending money to the Philippines.

Here’s how I plan to use it. As soon as I arrive in the US I’ll link Wise to my US bank account. That way I can safely hold some money aside to spend during my first month. The first month is tricky. You need cash for groceries, transport, maybe a few household items, and honestly just for small emergencies that pop up. Wise lets me do that without worrying about losing money to hidden fees or bad exchange rates. I can just focus on settling in without constantly stressing about money.

Another big perk is sending remittances. With Wise I can send money back to my family in the Philippines almost instantly. The fees are tiny and they actually use the real exchange rate the one you see on Google. That’s a huge deal because banks and remittance centers always sneak in hidden costs. Watching my mom use it really sold me on this and now I’m taking that advantage for myself.

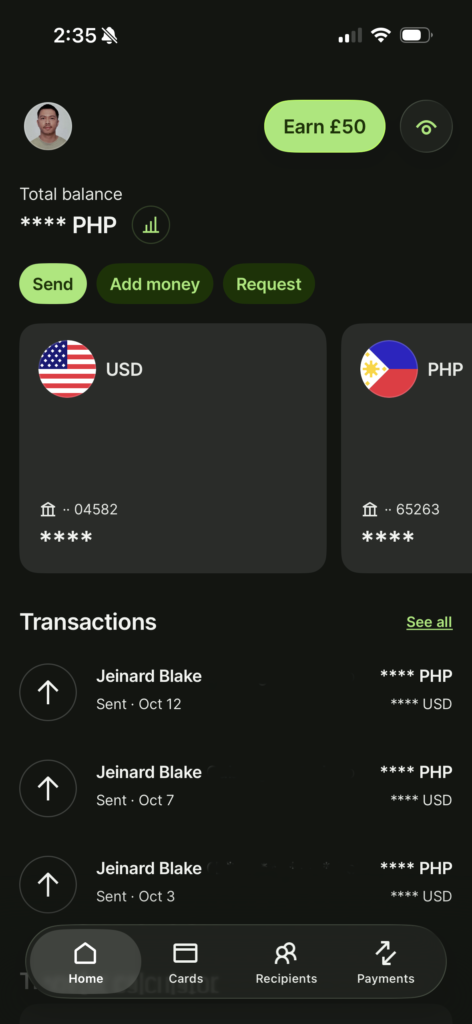

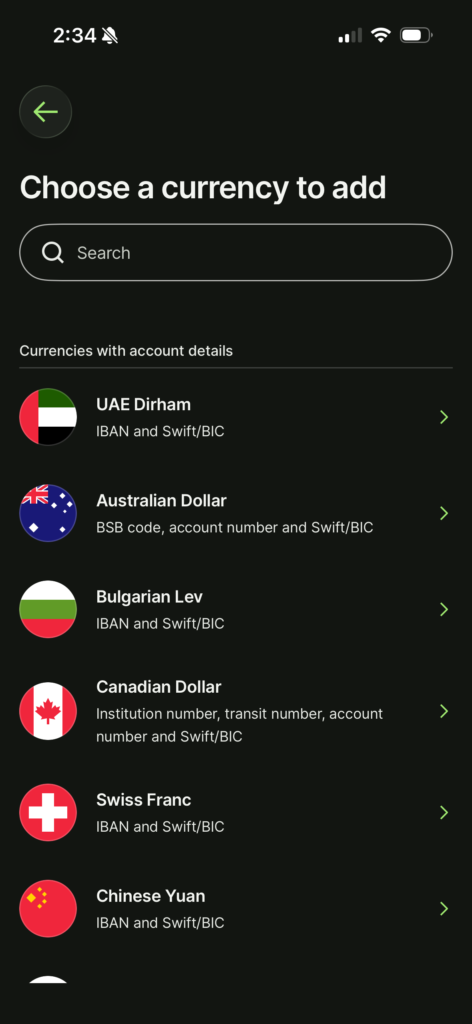

One of my favorite things about Wise is how flexible it is. I can hold multiple currencies at once. So even if I’m paid in USD I can keep some PHP or other currencies if I travel again. That kind of flexibility is nice because it feels like having a mini bank that’s way smarter than a regular one. And the speed, transfers are usually instant or take just a few hours. For someone like me who likes to keep track of every peso, that’s huge.

Setting it up is also super simple. I could even do most of it before leaving the Philippines. I linked my local bank, verified my account and now it’s ready to go. No stress about opening new accounts once I land, no running around for documents, no waiting days to access my money. Honestly that small piece of convenience is already taking a load off my mind.

I know Wise isn’t perfect. Sometimes transfers can take a little longer than expected, and of course tech issues happen. But for what I need, managing my first month in the US and sending money home, it’s just perfect. It’s like a tiny safety net that I can trust.

So if you’re moving abroad, or even planning a short stint in another country, I highly recommend checking out Wise. It’s more than just a way to send money, it’s a tool to make your life easier, safer and more predictable when everything else feels so new and uncertain. For me, it’s a small but solid piece of peace of mind in what’s otherwise a huge adventure.

Landing in a new country is intimidating but having Wise makes me feel like I’ve got one less thing to worry about. I can focus on the fun parts, finding my favorite coffee shop, exploring my new neighborhood, and slowly building a life in a place that used to feel so far away. And knowing that I can still support my family back home while taking care of myself, that’s priceless.